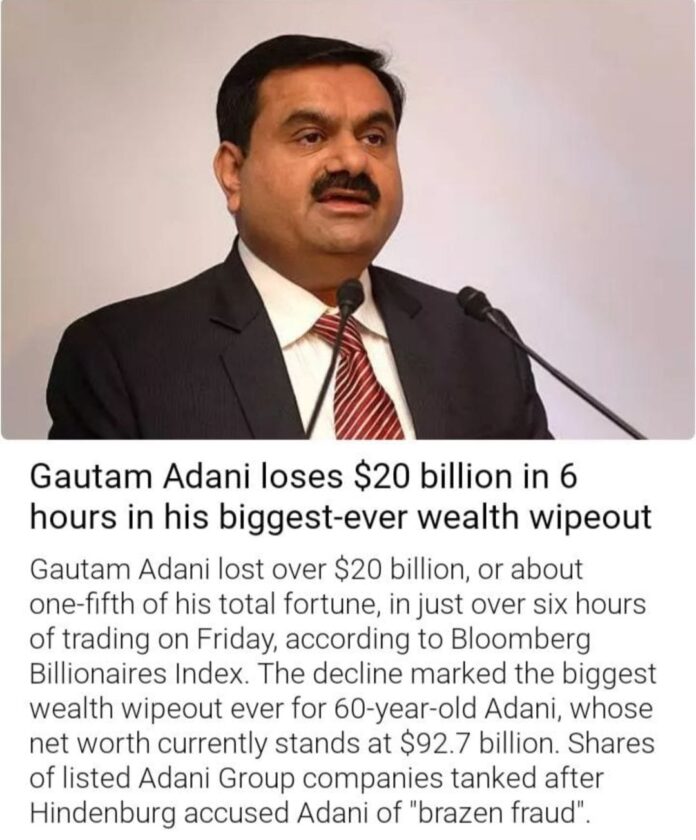

Indian billionaire Gautam Adani loses $20 billion, about one-fifth of his total fortune, in just over 6 hours of trading on Friday, according to Bloomberg

There were allegations by activist investment firm Hindenburg Research on Wednesday, January 25 of massive fraud and stock manipulation by the Adani group. After activist investment firm Hindenburg Research published a derogatory 100-page report on Gautam Adani and his group, alleging massive fraud and stock manipulation.

New reports say that Adani Group Stocks lost $48 billion over Hindenburg fraud claims, LIC shares crash, and Adani, who started the week as the world’s 3rd-richest person, now ranks seventh on Forbes’ billionaire tracker.

Kunal Kamra “Market manipulator @gautam_adani

ko Hindi main Chor aur English main Fraudster kehne ab sahi hoga…

Market manipulator @gautam_adani ko Hindi main Chor aur English main Fraudster kehne ab sahi hoga… https://t.co/vQtKqRq1fb

— Kunal Kamra (@kunalkamra88) January 26, 2023

Gautam Adani slips 4 positions on Forbes rich list amid a drop in the stock prices of the companies in Adani Group, where he slipped from 3rd to 7th position on the list of the world’s richest people, as per Forbes Realtime Billionaires.

Media reports said the stocks of companies in Gautam Adani’s highly diversified conglomerate continued to drop since Wednesday post a report by American short-seller Hindenburg Research.

On Friday, the group’s stocks crashed over 20 percent, which is also reflected in the muted response received by Adani Enterprises FPO by investors across categories.

As per the Forbes list, Adani lost $22.6 billion since the report was made public.

Gautam Adani’s net worth dropped to $96.6 billion from $121 billion before the Hindenburg report, according to Forbes.

Hindenburg Research had raised concerns about high debt at the group and accused it of improper use of entities set up in offshore tax havens – a charge the group denies, according to Reuters.

The report alleged corporate misgovernance, stock price manipulation, and high leverage of the group.

Bankers on the deal were thinking of extending the sale or cutting the issue price after shares of Adani plunged following a report from a U.S. short seller, three people familiar with the matter told Reuters on Saturday.

Seven listed companies of the conglomerate owned by one of the world’s richest men, Gautam Adani, have lost a combined $48 billion in market value since Hindenburg Research on Tuesday flagged concerns about debt levels and their use of tax havens.

The Adani Group has called the report baseless and said it was considering taking action against Hindenburg.

Sources had said that among the options the bankers were considering included extending the Tuesday subscription closing date by four days.